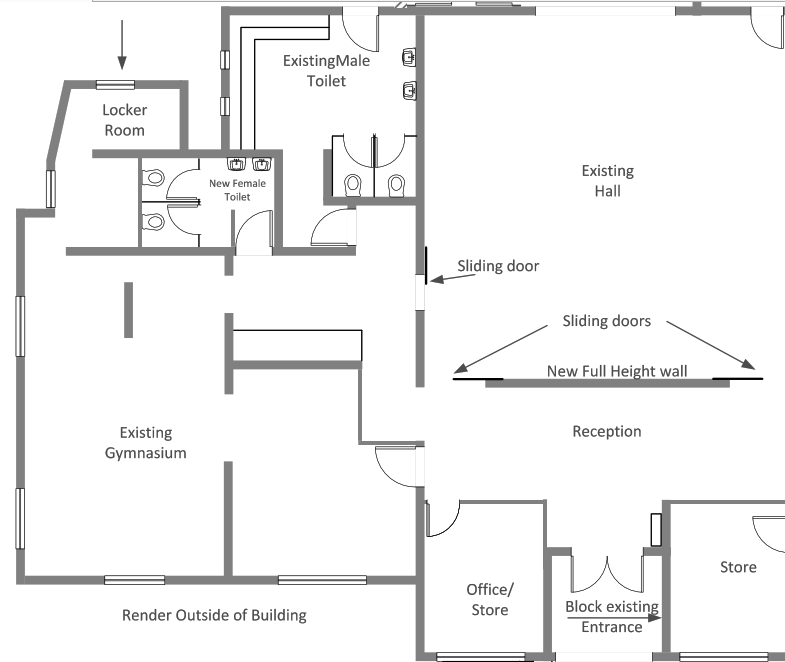

Whenever you’re looking at your first studio location or you’re looking to open a new location it’s important to have a solid projection of what everything is going to cost going into it. The reason is that you’ll want to know what your budget should be set at and if the breakeven is going to be worth it. Sometimes, 2 different spaces can vary widely and it’s best to take into account all your one-time and fixed costs before committing to a space. In this post I have laid out for you the top soft and hard costs to calculate before you make the jump...

When I was looking to finance my Studio 15 years ago, I was lost. I had no idea of my options, and there was no-one I could lean on for advice. I had exhausted all the traditional methods to secure finance until one day, when I least expected it, an opportunity arrived and I grabbed it with both hands!

Let’s be honest.. opening your own facility is what every trainer aspires to. The pinnacle of the Industry, it’s when you have made your mark and gone to the highest level. It was always my ultimate goal to open a facility and have something I could call my own. To change the lives of the local community, create a place of education and inspiration, and to be able to say.. that’s mine, I CREATED that!

Let's backtrack a little.. it's November the year before, you're winding down to Xmas, it's been a solid year of work and you've made some decent money so you're feeling good and satisfied. That's cool, but because it's your first year in business you probably haven't experienced the next few months... now if it's not your first year in business and this is happening regularly then you definitely have to keep reading! Now, this used to be my routine for the first 3 YEARS of having my own Studio! I made good money through the year, then closed the Studio down for 2 weeks over Xmas, recharged the batteries and went back mid January ASSUMING all the clients would come back with me... seems logical, but this was a hope, not a plan. I'm a slow learner - but after the third year of this happening where I had a decent year and then suffered for the following 6 weeks between December and January, I had to make a change. After I implemented the following strategies, December ended up being my BIGGEST month of the year and set me up for the reduced cash flow in the January period when my clients were away. Here are a few things I do REGULARLY now to ensure I make solid cash over the Xmas and New Year Holiday period..