Starting a Studio for $0 Down..

When I was looking to finance my Studio 15 years ago, I was lost. I had no idea of my options, and there was no-one I could lean on for advice. I had exhausted all the traditional methods to secure finance until one day, when I least expected it, an opportunity arrived and I grabbed it with both hands!

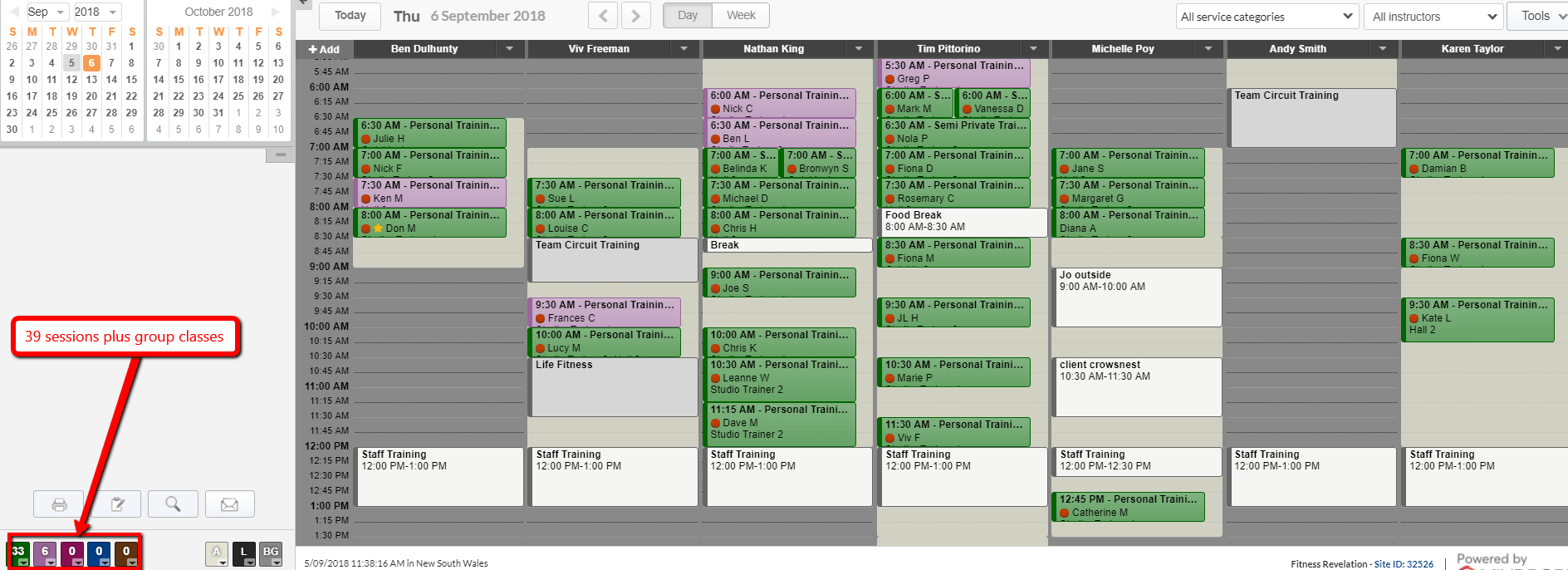

Back in 2004 I had no huge savings and no constant income. There was $5,000 in my bank account, I had just bought my first property (so ALL my money went into that) and I had around 20 PT clients that allowed me to live from week to week.

When the opportunity came up for me to start my own Studio, I was SUPER keen and knew I could make it work, but I just needed some help getting started.

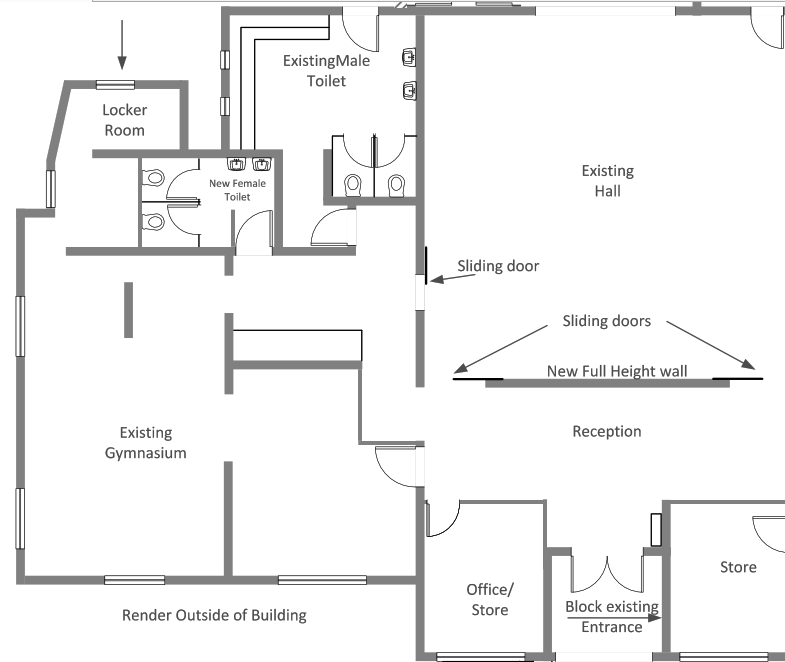

I worked out I needed $30K to get me started. This would be used on a simple fitout with some basic equipment plus cover Rent and marketing for the next 6 months.

So, I went to my bank and applied for a Business loan, and they didn't lend me the money. So I asked for a credit card. Normally I avoid Credit cards, but I found one that had 0% interest for 6 months.. and I KNEW I could pay any debts off in that time with the cashflow I would generate from my existing clients and news sales. That got rejected too.

I tried to extend my mortgage obligations with the bank, but due to the fact we had JUST borrowed so much, they wern't willing to lend any more.

I went to a finance broker and they didn't lend me the money to even finance fitness equipment due to the fact I had no credit rating (due to a poor cashflow, young business, and no solid assets)

So, I was stuck - no cash to get started, only dead ends.

I actually thought this opportunity was going to pass me by, until one night, after finishing a session with a client, I was telling him of my inability to finance the proposed new studio, he suggested I borrow the money off him and pay him back over 12 months with ZERO interest. The only trade off was he got FREE training for the year.

WHAAAT? (I said in my mind) that's an awesome deal! No brainer for me and the next day we got started on the finer details.

The rest is history.. I borrowed $30,000 off him, paid it back IN FULL within the year and then owned all my equipment outright too.

This was a true example of making the most of opportunities that are around you. It didn't occur to me that I could ask my existing member base for assistance. In fact, back then I thought it would have been rude to ask.

But really, your clients WANT to help you, and assist with your success.. they are your biggest fans.

And of course, it's in their best interest to help you, as it keeps you motivated and provides them with a brand new facility to train out of too!

Remember though, getting the $30K was just the beginning. I was then on a mission to pay that back ASAP and start building the empire.

My story is not an unusual one. I know there are loads of Fitpro's out there struggling to get started with their finance.

To help with the process of acquiring finance, check out my article on Leasing Equipment- this is what I have been doing for bigger upgrades the last few years :)

Yours in Fitness Business Success,

Ben Dulhunty